My husband, Gary Spurlin, was an active man who was proud to have served in the U.S. Army in Vietnam at the age of 17, and later worked in law-enforcement and actively participated in karate, weightlifting and football. So when he started feeling that his muscles were too weak to do the things he loved, he knew something was wrong. There is nothing in life that can prepare you for hearing that your husband of 19 years has ALS, or Lou Gehrig’s disease.

We were shocked by Gary’s diagnosis, but Gary’s doctor at the Southern Nevada VA Healthcare System in Las Vegas was extremely compassionate and helped us with the paperwork to get us into the VA system quickly. He patiently answered all of our questions from “What can we do?” to “What can we expect?” Understanding our options led us to make the decision to sell our home in Las Vegas and move 500 miles to be closer to our children and grandchildren. We knew that time with our grandchildren would improve Gary’s quality of life and make my caregiver’s duties a little lighter.

As Gary’s disease progressed, he moved to in-home hospice where we focused on making the most of the rest of his life by adapting our new home to make him more comfortable. Gary applied for a VA Specially Adapted Housing Grant to help us make changes and he was quickly approved. That qualified him for Veterans’ mortgage life insurance which could pay up to $200,000 towards the mortgage at the time of death.

Our focus then turned to financial issues. Gary’s number one concern was how I would be able to afford our new home after he had passed. Once again, VA was there to help us. With the assistance of VA Loan Guaranty employee Kelly Neuner, our VMLI application was faxed to the VA Insurance Center the same day Gary applied.

With Gary’s worsening condition, we didn’t know if he would receive an answer on whether or not he was approved for VMLI before he passed. Much to our surprise, the application was approved that same day. In fact, we were notified by VA Life Insurance Center employee Nancy Encarnado that our VMLI application was approved within a matter of hours.

Nancy recognized the urgency of our situation, and she took the extra steps to find some missing papers so she could approve the VMLI application, as well as another application for Service-Disabled Veterans Insurance (S-DVI). The due diligence and commitment she took to process Gary’s claim so swiftly still brings tears to my eyes, and I know it lifted a huge burden from Gary’s shoulders.

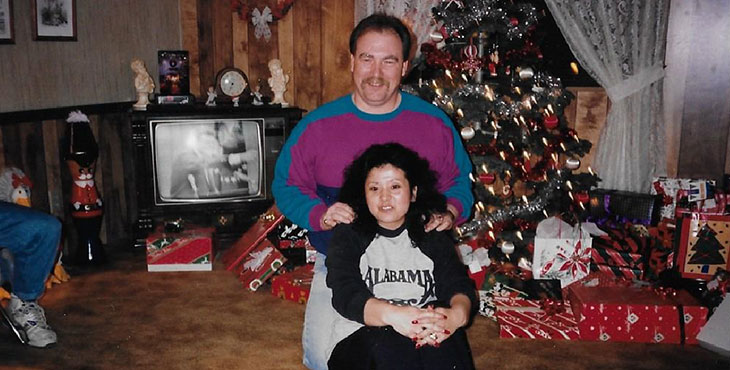

Gary and Patricia Spurlin. The Spurlins used VA insurance programs, including VMLI and S-DVI, when Gary was diagnosed with ALS.

But, our story doesn’t end there. Fortunately, Gary lived four more months and Nancy called every couple of weeks to check in and make sure all his VA insurance issues were in order. Her calls would always brighten my day, and even when Gary passed, she stayed on top of everything. The S-DVI payment was paid within a day of receiving the death certificate, and the VMLI mortgage payment was sent to the mortgage company within four days. The payment greatly reduced our mortgage and the check I received for S-DVI allowed me to pay off the remainder.

I promised Gary I would make sure to tell the story of how Kelly Neuner, Nancy Encarnado and all of VA treated my husband and my family with concern and respect. They exceeded my expectations and provided us with excellent customer service during this very difficult time. Gary was at peace knowing that VA had taken care of his family.

Veterans’ Mortgage Life Insurance (VMLI) is available to Veterans who are approved for a VA Specially Adapted Housing Grant and apply before age 70. The maximum amount of insurance a Veteran can purchase is $200,000, which will be paid directly to the mortgage company when a policyholder dies. You can find more information about eligibility for VMLI here, and general information here.

Service Disabled Veterans Insurance (S-DVI) is available to Veterans discharged after April 1951 who received a rating for a new medical condition in the last two years. Even a zero percent rating applies. You can get more information about eligibility for S-DVI here and general information here.

About the author: Patricia Spurlin is the surviving spouse of a U.S. Army Veteran

Topics in this story

More Stories

The “Increase Your Credit Score” workshop will be a live event with credit experts whose aim is to help you bolster your credit score and financial stability.

Tax filing season has become a popular time for scammers to target unsuspecting taxpayers through multiple communication avenues. VA wants Veterans to remain vigilant against cyberattacks aimed at stealing personal and financial information.

The VA Health and Benefits mobile app is modernizing how Veterans access and manage their health care and benefits information.